Healthcare providers may not be aware that they are subject to a Single Audit (A-133 audit). Many healthcare providers faced significant financial changes due to the COVID-19 pandemic, including the following changes felt by many organizations.

- Additional costs associated with purchasing needed PPE

- Costs of additional support provided to your workers

- Revenue losses from cancelled surgeries and other services

- Deferred elective and preventive visits

- Costs to implement telehealth and other innovations

In response, the government provided numerous COVID relief packages. As a result of receiving these relief funds, many entities will need an Audit for the first time, including healthcare providers and nonprofits.

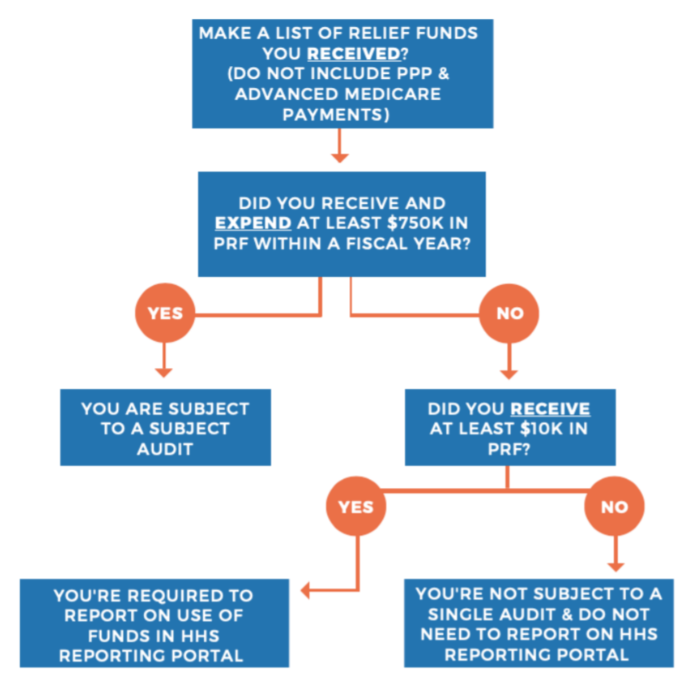

Are you subject to the Audit? Did you receive and expend more than $750,000 in COVID relief, including the following or other relief funds?

- Provider Relief Fund (PRF)

- Coronavirus Relief Fund (CRF)

- Education Stabilization Fund (ESF)

SBA has confirmed that Paycheck Protection Program (PPP) loans are not subject to an Audit.

Overview of the Single Audit

A Single Audit is required when a non-federal entity expends $750,000 or more of federal awards in a fiscal year.

If an organization expended less than $750,000 in a given fiscal year, an Audit requirement does not apply. Note that the amounts that trigger an Audit are the amounts of funds expended, not received.

The Single Audit Act Amendments of 1996 was enacted to streamline and improve the effectiveness of audits of federal awards and to reduce the audit burden on states, local governments, and not-for-profit entities. It is also referred to as a Uniform Guidance Single Audit. The regulation contains detailed implementation requirements.